The Value Reporting Foundation today publishes Transition to integrated reporting: A Guide to getting started to help report preparers develop a custom-fit transition plan to integrated reporting. The Guide is a companion to the <IR> Framework, the principles-based, multi-capital framework used to accelerate integrated reporting across the world. Integrated reporting helps businesses think holistically about their strategy to build investor and key stakeholder confidence and improve future performance. With integrated reporting now being adopted in more than 70 countries worldwide, by over 2,500 organizations and with support from 40 stock exchanges and counting, more and more organizations are experiencing its benefits for business decision-making and long-term value creation.

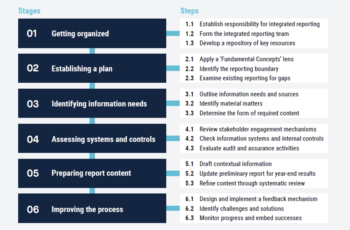

The Guide explores the basics of integrated reporting, identifies potential catalysts for change, and offers a steppingstone approach to implementation. The sample roadmap, as shown in the diagram from the Guide, helps report preparers navigate their own unique circumstances, prompts ideas and supports the design of their tailored integrated report.

Michael Gebbert, Transformation Accounting and Taxes, EnBW and <IR> Framework Board Member, said: “Close collaborations between functional and business units is the key to transparent, meaningful and comprehensive integrated reporting. For our company both internal and external added value arises from the interaction of these units.”

Lisa French, Chief Technical Officer – <IR> Framework, Value Reporting Foundation, said: “We are pleased to publish the Transition to integrated reporting: A guide to getting started, which not only introduces the basics of integrated reporting to those setting out on their journey, but also converts high-level concepts into concrete action. Drawing from the rich insights and experience of those who have applied the International <IR> Framework over eight years, the guide also appeals to businesses seeking to improve their current approach to integrated reporting. Now more than ever, integrated reporting is important as we face the unprecedented risks posed by climate change and the global pandemic. As capital markets increasingly demand disclosure on intangible assets, more organizations are turning to the <IR> Framework to strengthen their reporting. By communicating how strategy, governance, performance and prospects create, preserve or erode value over time, businesses are enabling better decision making and delivering more complete and concise information to investors and key stakeholders.”