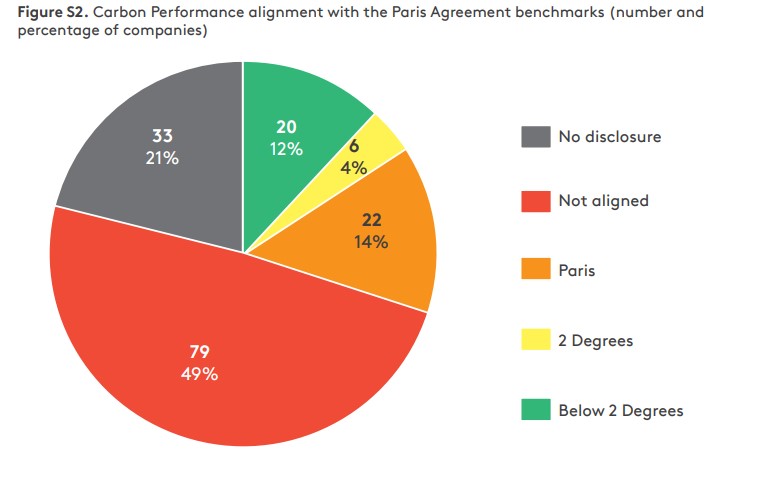

A major new report assessing the climate performance of 274 of the world’s highest-emitting publicly-listed companies finds that almost half (46%) do not adequately consider climate risk in operational decision-making. A quarter (25%) do not report their own emissions at all, undermining a key recommendation of the Taskforce for Climate-related Financial Disclosure (TCFD). The report assesses companies on ‘Management Quality’ related to climate, but also goes further and analyses ‘Carbon Performance’, in terms of current and planned GHG emissions. A total of 160 companies are analysed on Carbon Performance and the research finds that only 20 companies, or one in eight, are aligned with a pathway that would keep global warming below 2°C.

Adam Matthews, Co-Chair of TPI and Director of Ethics & Engagement at Church of England Pensions Board said:

“TPI’s research shows that we need many more investors to engage with big-emitters across all sectors of the economy to ensure companies are setting emissions targets consistent with the goals of the Paris Climate Agreement. Engagement is starting to show results but not at the pace needed. A failure to grasp the seriousness of the warning from this TPI report, and to recognise the slow pace of corporate progress, will directly undermine our ability as pension funds to manage the financial risks within our portfolio for our beneficiaries.”

“The clock is ticking on irreversible climate change. The fact only 1 in 8 of the highest-emitting firms are responding at anywhere near the pace required is an urgent challenge to investors. Investors themselves need to adopt an emergency footing otherwise the window to secure the change we need will be gone.”

The study was carried out for the Transition Pathway Initiative (TPI) by the Grantham Research Institute on Climate Change and the Environment at the London School of Economics. It uses FTSE Russell data to analyse leading companies in 14 carbon-intensive sectors such as Oil and Gas, Electric Utilities, Automobiles, Airlines and Steel. These sectors account for 41% of global emissions from publicly listed companies worldwide. TPI is backed by investors with $14 trillion of assets including pension funds such as CalPERS and Environment Agency Pension Fund, and asset managers such as Legal & General Investment Management, BNP Paribas, Aberdeen Standard and Robeco. This report builds on TPI’s first ‘State of Transition’ report released a year ago.

Faith Ward, Co-chair TPI on behalf of the Environment Agency Pension Fund, part of the Brunel Pension Partnership. added:

“Today’s research shows clear leaders and laggards emerging within sectors from airlines to aluminium – and that gives investors an investment-relevant decision to make today. As the effects of climate change accelerate we can expect to see more capital flow away from those companies that bury their head in the sand, and towards those companies aligning with a 2°Cpathway.”

“The failure of 25% of high-emitting companies to report their own emissions is putting investors in a Catch 22 situation on disclosure. The UK is one of several countries moving to make climate risk reporting by asset owners mandatory, yet without emissions data from a quarter of the high emitting companies that request will be impossible to deliver.”

Professor Simon Dietz, Co-Director of the Grantham Research Institute on Climate Change and the Environment, and lead author of the report said:

“It’s over three years since the Paris Agreement was signed and this research shows the corporate sector is improving its climate planning and performance, but not fast enough. Cutting through the noise we can see that barely 12% of companies plan to reduce emissions at the rate required to keep global warming below 2°C.”

The report findings also include:

- 46% of companies are not adequately integrating climate change into their business decisions.

- 25% of companies do not disclose their own carbon emissions.

- Among the companies assessed for the second consecutive year, 35 of 130 companies (27%) improved how they integrate climate change into their business decisions.

- 84% of companies do not disclose an internal carbon price; and 86% are yet to undertake and disclose climate scenario planning – a critical part of TCFD reporting.

- Only 16% of companies assessed for their current and planned GHG emissions are aligned with the 2°C benchmark.

- Only 12.5% of companies assessed for their current and planned GHG emissions are aligned with the most ambitious below 2°C benchmark. These include E.ON, Iberdrola, Stora Enso and Edison International.

Meryam Omi, Head of Sustainability and Responsible Investment Strategy, Legal & General Investment Management, said:

“All sectors must play a role in meeting the climate challenge. TPI’s new report shows clearly that progress is being made, but also that significant gaps remain between the leaders and laggards in each sector. The climate emergency requires a consistent investor voice – we will continue to work alongside TPI partners to push companies to adopt sustainable business models.”

Carola van Lamoen, Head of Active Ownership at Robeco Asset Management said:

“TPI’s State of Transition Report 2019 shows encouraging progress as a growing number of companies commit to aligning their strategies with the Nationally Determined Contributions of signatories of the Paris Agreement. While companies leading on the energy transition start to emerge, investors should continue engaging with companies that are yet to integrate climate change in their operations and business strategy. Robeco welcomes TPI’s research and its findings help us sharpen our engagement efforts for the year ahead.”